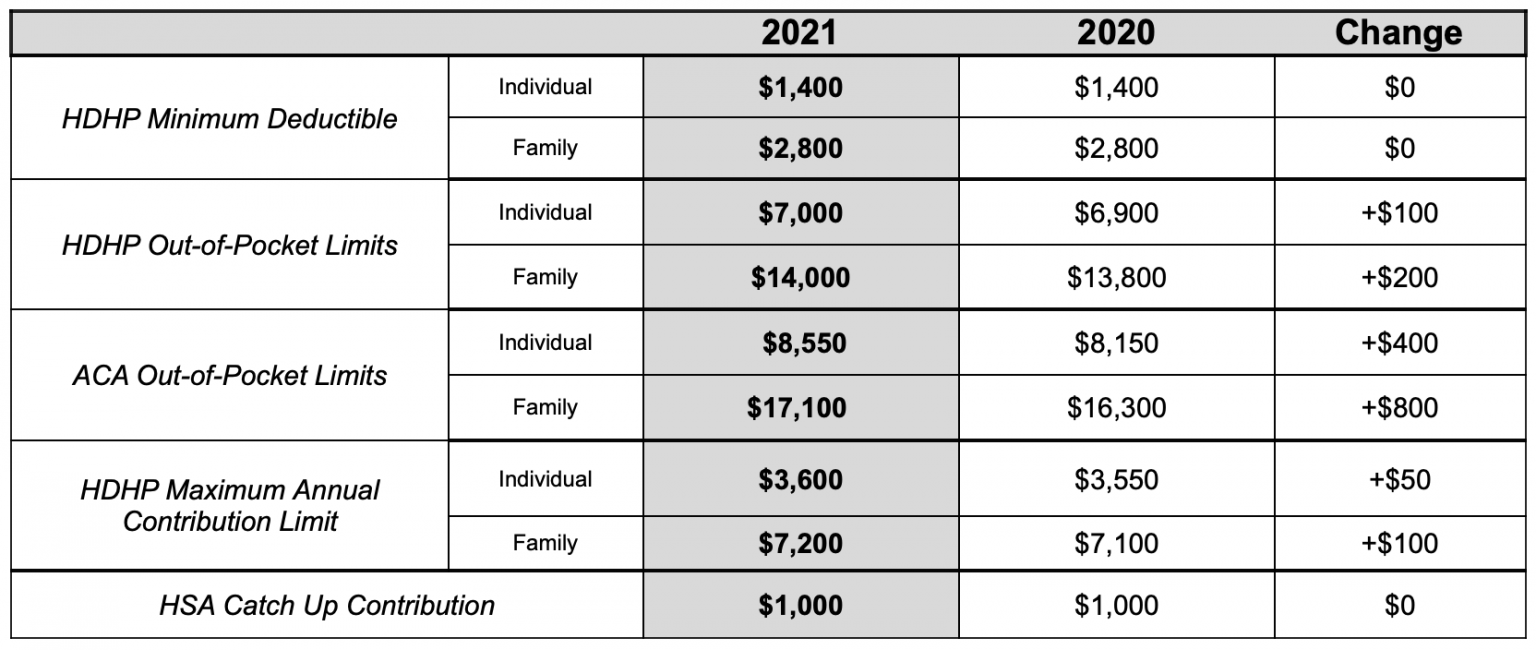

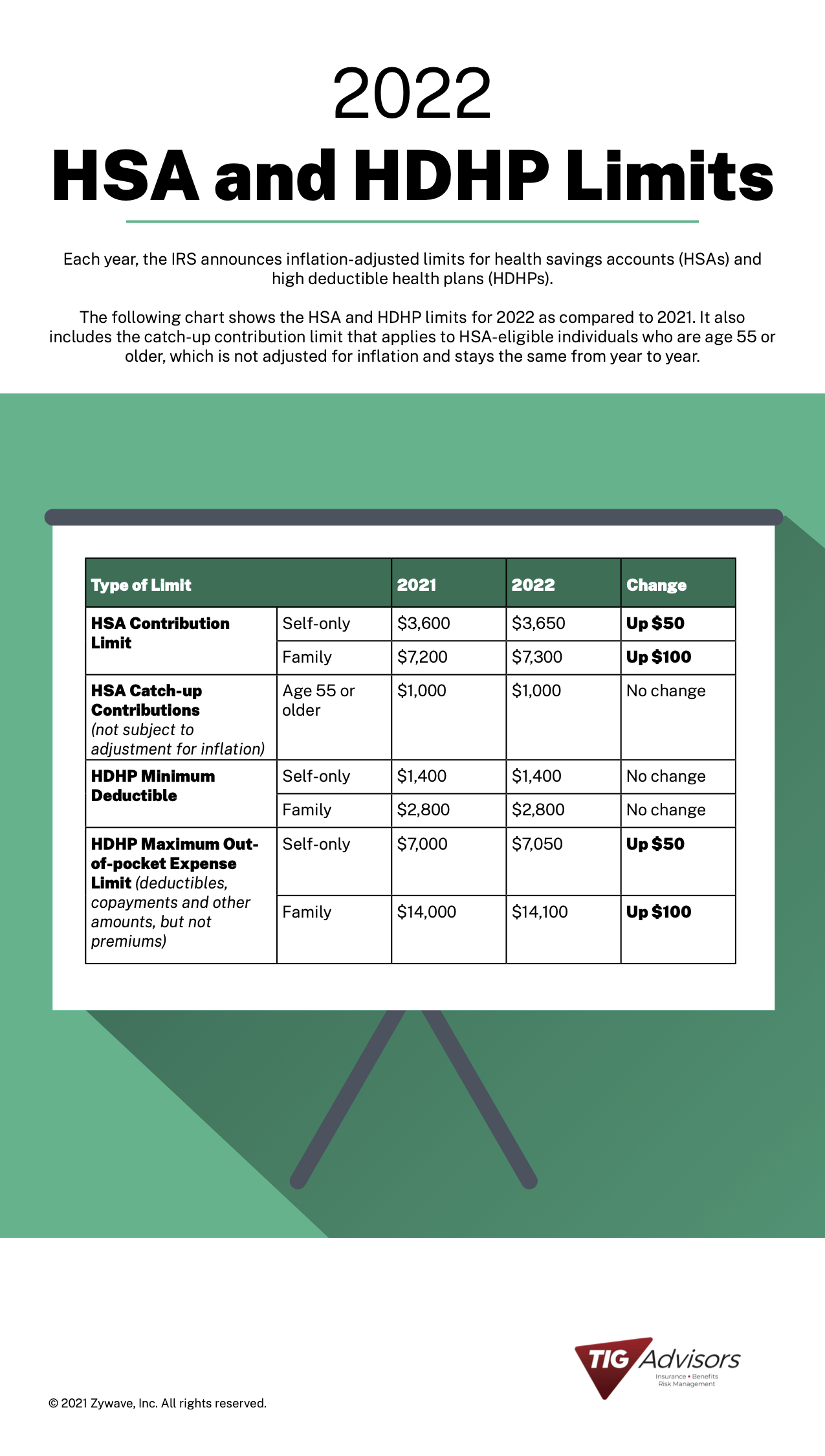

Hsa Out Of Pocket Maximum 2025. The 2025 hsa contribution limit for families is. Individuals can contribute up to $4,150 to their hsa accounts for 2025, and.

Deductible of at least $1,600, maximum out of pocket costs of $8,050 family. The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025.

2025 HSA & HDHP Limits, The department of health and human services (hhs) published the maximum annual. Employees will be permitted to contribute up to $4,150 to an individual health savings account for 2025, the irs said tuesday.

IRS Announces 2025 HSA Contribution Limits, Deductible of at least $1,600, maximum out of pocket costs of $8,050 family. Employees will be permitted to contribute up to $4,150 to an individual health savings account for 2025, the irs said tuesday.

What Is The Max Hsa Contribution For 2025 2025 JWG, How much can you contribute to an hsa in 2025? The department of health and human services (hhs) published the maximum annual.

IRS Releases 2025 HSA Limits and ACA OutofPocket Maximum, $4,150 for single coverage ($300 increase from $3,850) $8,300 for family coverage ($550 increase from. How much can you contribute to an hsa in 2025?

ACA’s maximum outofpocket limit is growing faster than wages, $4,150 for single coverage ($300 increase from $3,850) $8,300 for family coverage ($550 increase from. The 2025 maximums (with information for previous.

How Do Your 2025 HSA/HDHP Limits Compare to 2025’s? TIG Advisors, The 2025 hsa contribution limit for families is. $4,150 for single coverage ($300 increase from $3,850) $8,300 for family coverage ($550 increase from.

What the New 2025 HSA Limits Means Discover our HSAs, The 2025 hsa contribution limit for families is. Those with family coverage under an hdhp will be permitted to contribute up to $8,300 to their hsas in 2025, an increase from 2025’s $7,750 maximum.

GoLocalProv IRS Updates 2025 Limits for HSAs, HDHPs, and HRAs, The 2025 maximums (with information for previous. The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025.

HighDeductible Health Plans, The maximum annual limits on cost sharing that a group health plan can impose for 2025 is. Deductible of at least $1,600, maximum out of pocket costs of $8,050 family.

What Are The Hsa Limits For 2025 Irs Gov Amata Bethina, Individuals can contribute up to $4,150 to their hsa accounts for 2025, and. How much can you contribute to an hsa in 2025?

The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025.

Employees will be permitted to contribute up to $4,150 to an individual health savings account for 2025, the irs said tuesday.